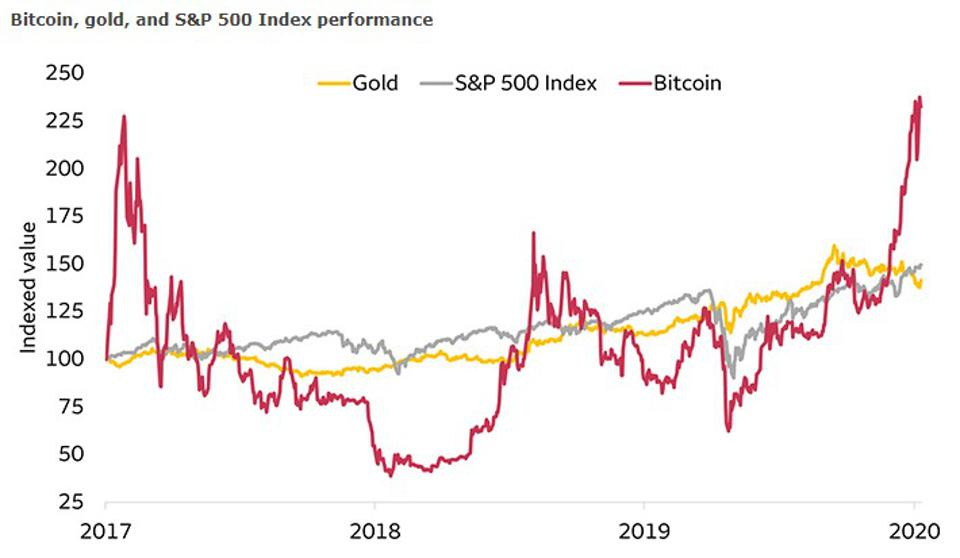

The price of Bitcoin surpassed $20,000 for the first time in its 11-year history on Wednesday, December 16th and then surpassed $23,000 the following day. Bitcoin is up around 200% year-to-date and up over 300% from its March lows. This year has been pivotal for Bitcoin as demand from retail investors as well as large institutions and high profile investors increased significantly. This year Bitcoin was adopted by payment giants including CashApp and Paypal. CashApp’s users can now purchase and spend Bitcoin on the app. Paypal has launched a service allowing its 286 million active users to buy, hold and sell Bitcoin among other cryptocurrencies. Tech firms have also added Bitcoin to their balance sheet. This year, MicroStrategy purchased over $500 million in Bitcoin and is planning to continue buying more in 2021. Square also purchased $50 million in Bitcoin noting that it 'aligns with company's purpose'.

The difference between this years rally and the rally of 2017 is that the price of Bitcoin is being driven by institutional demand rather than retail speculation. Investors could see Bitcoin as a store of value similar to gold due to its deflationary nature. Bitcoin has a limited supply so price will follow as demand continues to increase. As central banks around the world have ramped up government spending and issued stimulus bills in the wake of the pandemic, investing in Bitcoin could be a potential hedge on inflation. Investors and companies alike must consider the opportunity cost associated with holding cash and ignoring Bitcoin as an emerging asset class.