1. Determine your goals

First decide how much time you will allocate towards picking individual investments. If the idea of analyzing financial statements is unappealing, consider buying ETF’s (Exchange Traded Funds) that track major indices instead; this will give you plenty of diversification and make for a good foundation to your portfolio. If you have an interest in investing, start with ETF’s then research and buy great companies that you deem undervalued.

Set a time horizon, this will be an important factor in determining how much risk you take. With a shorter time horizon, investors should take less risk as they have less time to make up for losses and usually more at stake. With a longer time horizon, for younger investors, you can afford to take more risk since you have time to make up for losses and usually less to lose. In any situation, only invest money you will not need for bills or emergencies during this period of time. You should only be investing if you have paid off debt and have substantial cash savings.

2. Risk tolerance

Determining how much risk you take also depends on your personal risk tolerance. You need to find an investment style that suits your tolerance for risk and you can only achieve this through practice. You need to invest in companies you believe in and you should be able to sleep at night knowing where your money is invested.

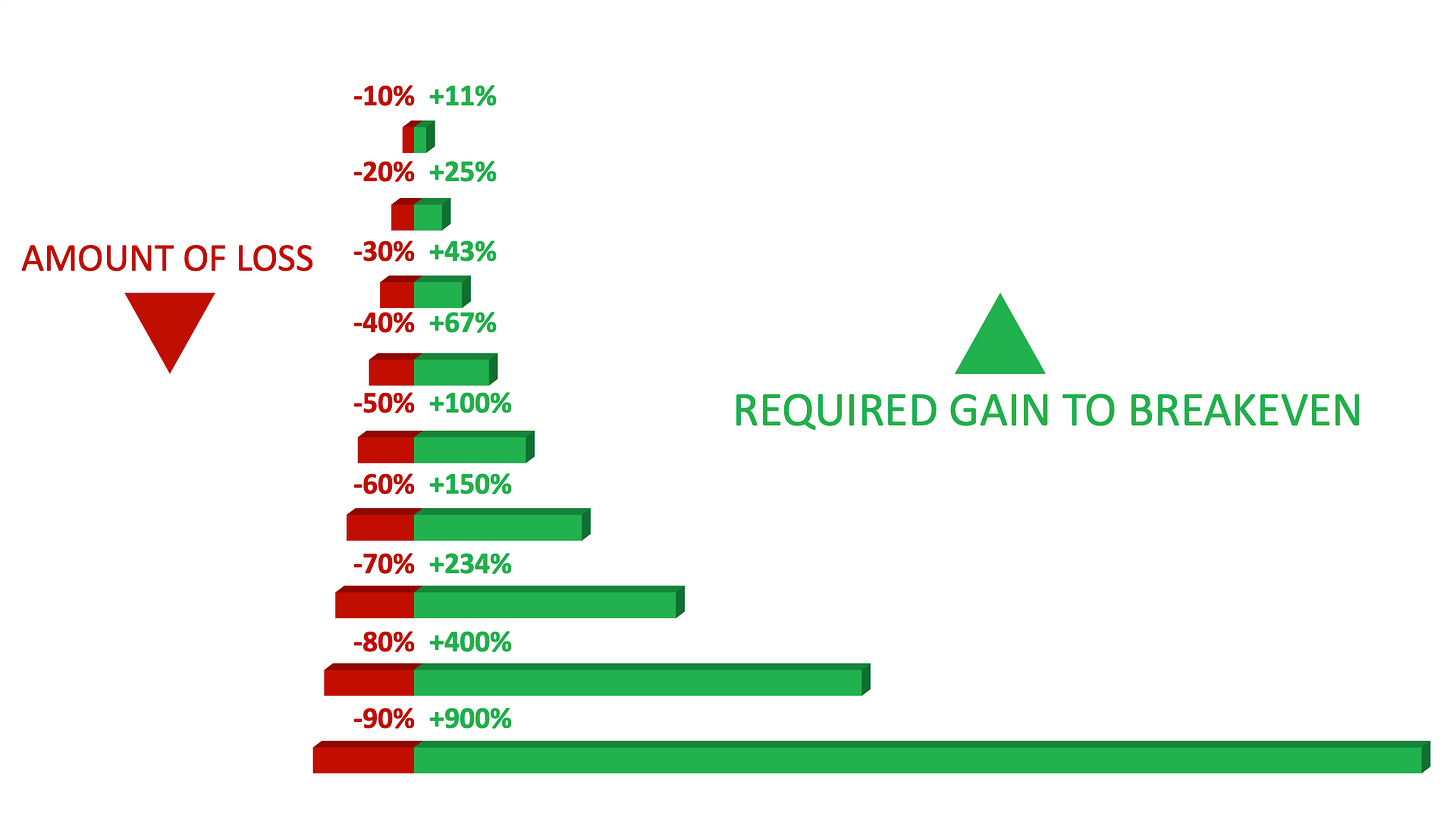

3. Do not lose money

The number one rule of investing is to avoid losses. If you see a stock drop from $50 to $0.50 it can be tempting to buy it, you might think: how much lower can it drop? The answer is it can drop all the way to $0. All time high prices are not promised, if you do not understand the financial situation of the company you are buying, you are taking a blind risk. The reason losses must be avoided is because it takes an exponentially higher gain to recuperate losses. This is why you should cut your losses short and let your winners run. In any case always understand the companies you own. If you buy a stock and it drops 50%, it will have to double (increase of 100%) in order to break even.

4. Focus on the long game

The problem with stock market news is that it inherently focuses on the present. This is contrary to the stock market which is forward looking. The goal of news media is very different from your goal as an investor. Profit driven media aims to get viewers and retain them, usually through sensational headlines. Your goal as investor is to grow your portfolio over time by thinking long term. Try not to stray away from your original investing strategy too often. The more you buy and sell, the more your transaction fees add up. The less you tinker with your portfolio, the more time it has to grow. Being able to control your emotions is difficult, but you must be unemotional to be an intelligent investor.

5. Specification over diversification

You will often hear that diversification is very important to risk management but when you look at some of the all time greatest investors they have built their wealth from owning a few stocks in specific industries where they have expertise. While you shouldn’t put all your eggs in one basket, you should try to understand a few companies or industries very well. This is referred to as your circle of competence. It will be almost impossible to understand 50 different companies, so just chose a few that are with in your circle of competence.

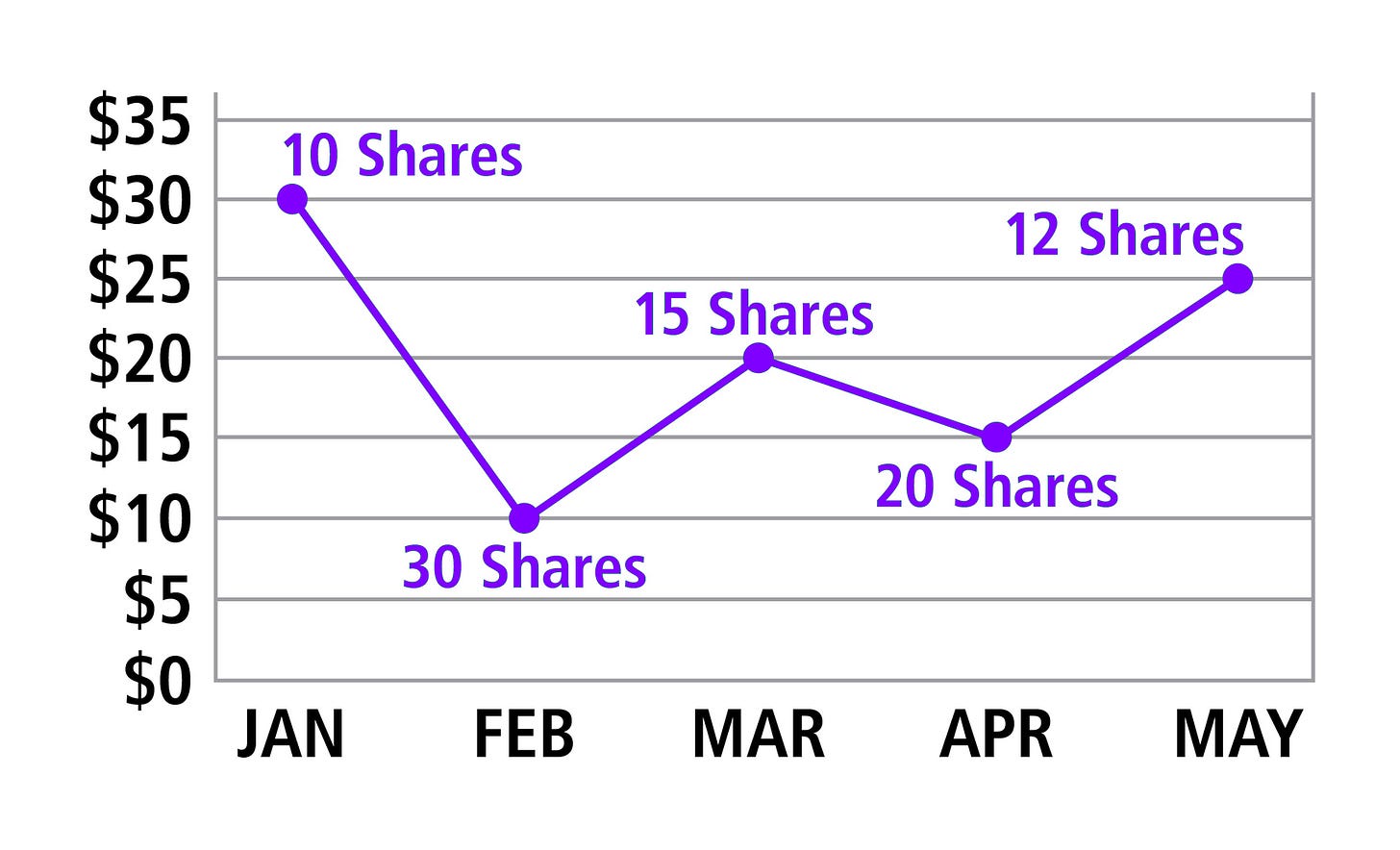

6. Dollar cost averaging

Another way of managing risk is dollar cost averaging. This is an investment strategy where you periodically purchase a stock over time in an effort to reduce the impact of price fluctuations on the overall purchase. By purchasing more shares when the stock dips you can bring down you average cost basis. In this example, if you had bought 87 shares in January your average cost would be $30, and you would be at a loss by May when the price is $25. By dollar cost averaging the 87 shares from January to May you bring your average cost down to $17.24. The share price could have continued to go up after January, but you wouldn’t be able to predict that and by dollar cost averaging you effectively manage your risk.

7. Time in the market beats timing the market

New investors may try to wait for the next big crash to invest in the stock market. While it sounds like the right thing to do in theory, the stock market is unpredictable, it can crash suddenly, or it can continue to rally for years. The best time to start investing is always now.

Amazing Work! Really informative and well written

Excellent and informative article!