More than a Buzzword

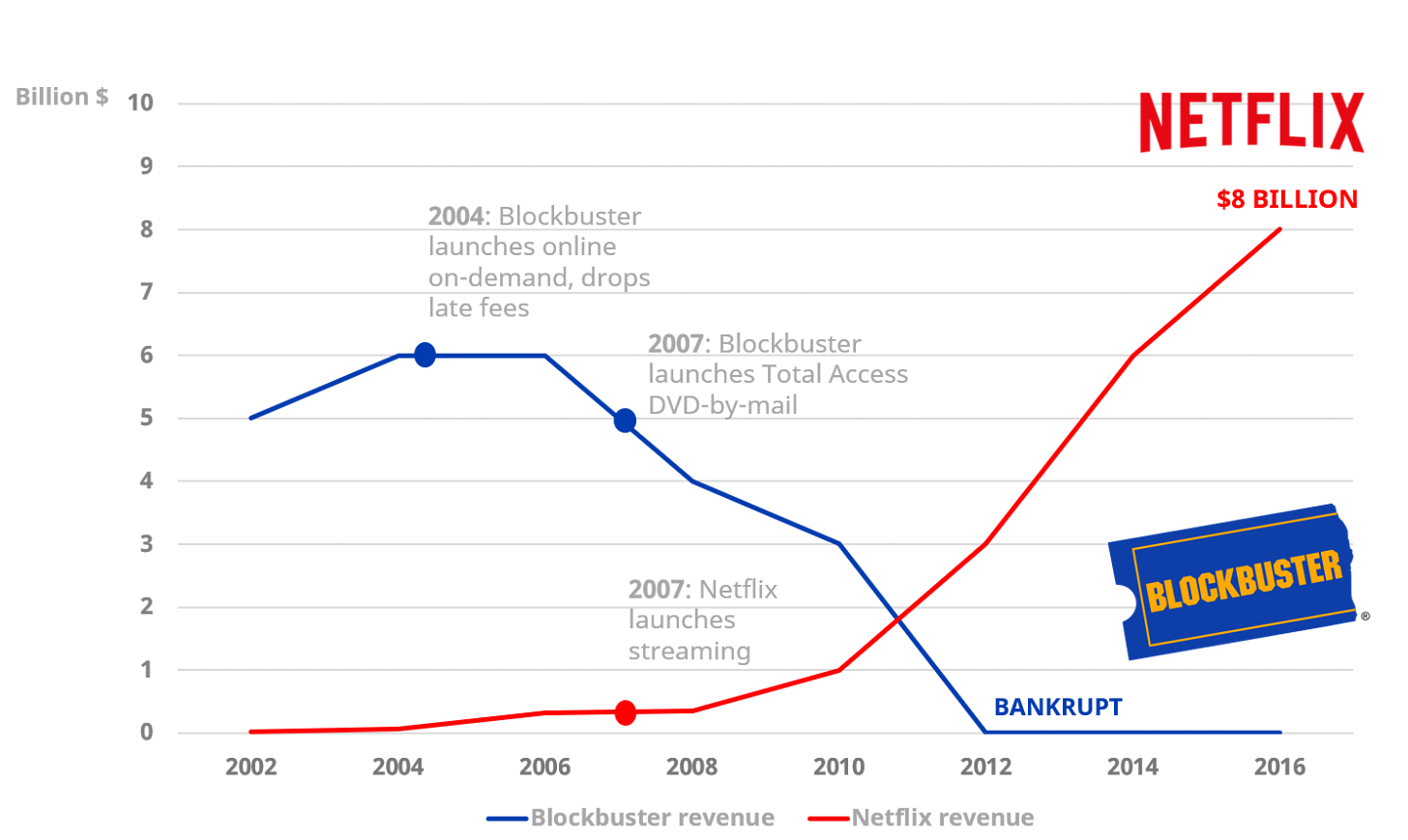

Disruptive innovation is another way of saying Creative Destruction which refers to “the incessant product and process innovation mechanism by which new production units replace outdated ones”. The term was coined by Joseph Schumpeter (1942), who considered it “the essential fact about capitalism”. An early example of creative destruction came from the internal combustion engine which displaced horse and buggy as a means of transportation. A more recent example would be the rise of Netflix and simultaneous collapse of Blockbuster. Netflix is a classic example of disruptive innovation because the company used a new business model and technology to disrupt an existing market. When Netflix launched its online, subscription-based movie streaming service, it surpassed Blockbuster in revenue soon after.

The Disruptors and the Disrupted

High-infrastructure companies including big oil, legacy automakers and banks are traditionally viewed as safe investments. In the age of innovation however, they may be riskier than you think. The risk associated with high infrastructure companies is that they are ripe for disruption. These companies typically payout earnings to shareholders through dividends rather than entirely reinvesting in their core business. While these companies have provided great returns in the past, they lack innovation while facing highly innovative competition. Innovative competitors of the future will use new technology to disrupt and displace established industry-leading firms by aggressively reinvesting, improving efficiencies and cutting costs exponentially as technology improves.

Dividends vs Reinvestment

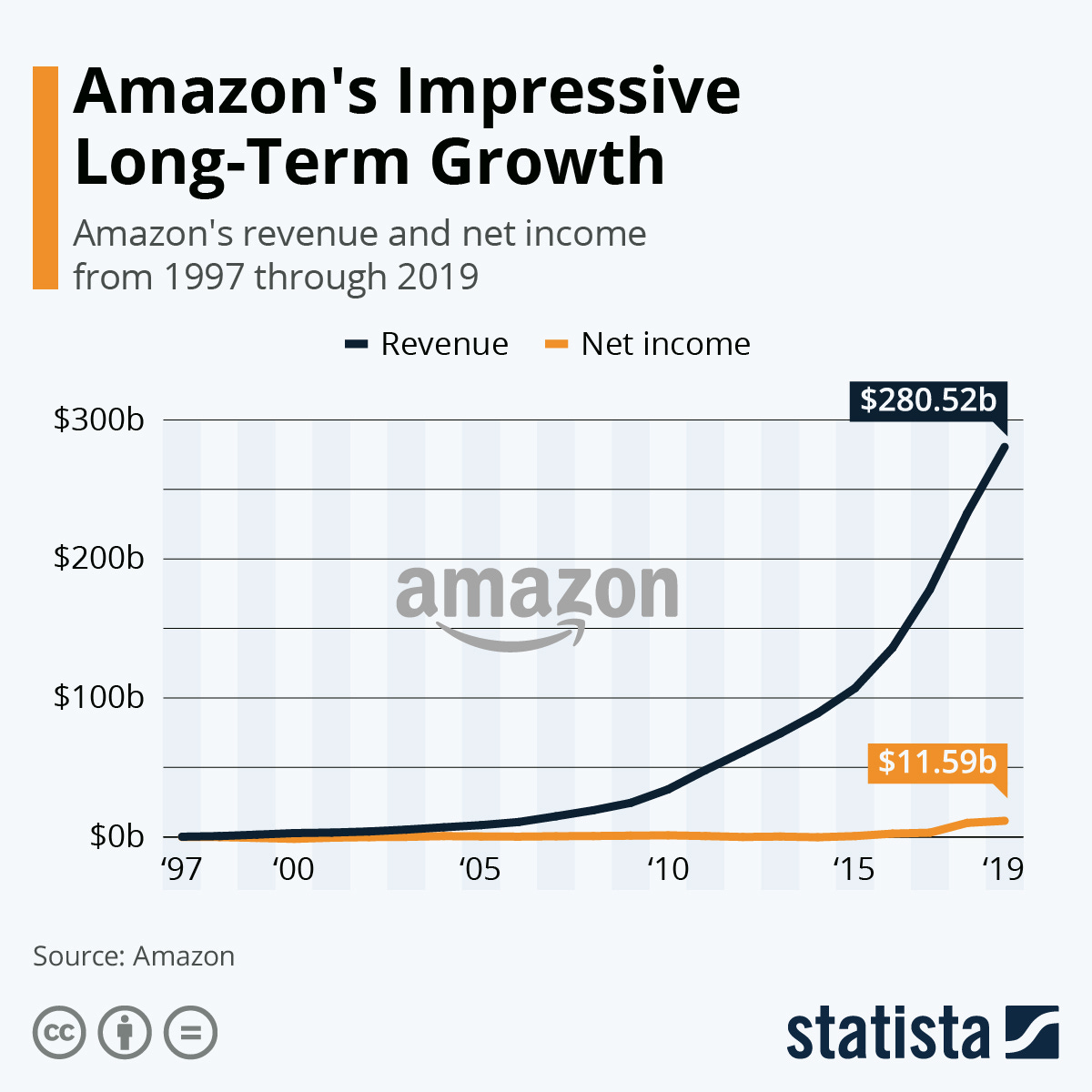

Amazon disrupted the retail space not only by innovating a new distribution method but also an entirely new business model whereby growth was valued over profitability. Amazon reinvested heavily into CapEx to grow the business rather than making a profit and paying out dividends to shareholders. This allowed them to reinvest in the core business, providing faster shipping and lower prices than its competition. As revenue grew significantly every year, net income remained close to zero. Walmart, Target and Costco prioritized profitability and rather than solely reinvesting earnings into the company, they passed on part of the profits to shareholders through the form a of a dividend. Instead of paying investors, Amazon passed on the earnings to customers by bringing down prices and providing faster shipping. This has given Amazon the biggest competitive advantage in the e-commerce and retail space. The zero profit model was an innovation that would not be favourable by traditional valuation metrics, only investors that could realize the pace of innovation could have caught on.

Disruption Risk vs Execution Risk

Identifying market disruptors is no easy task. While the risk associated with high infrastructure companies is that they could eventually be disrupted, the risk associated with disruptors is their ability to execute. Not all disruptors enter the market at the right time, they may not be able to take market share from companies that already dominate the market. It is up to the investor to recognize which companies can successfully disrupt the market. We live in a time of high innovation with major technologies developing such as AI, robotics, and energy storage. The trillion dollar question is how do investors capitalize on these opportunities?