Tesla Q3 2020 Earnings Highlights

Tesla exceeds revenue and profit expectations in it's best quarter yet

Deliveries

While most legacy automakers are seeing a decline in sales amid the pandemic, Tesla hit record deliveries this quarter with 139,593 vehicles delivered, producing more than 145,036 vehicles between July and September.

Revenue

Tesla expectedly beat revenue estimates as vehicle deliveries drive most of its earnings results. Wall Street estimated revenue of $8.26 billion which Tesla destroyed with $8.771 billion in revenue. Automotive sales made up $7.611 billion in revenue, $397 million of which came from regulatory credit sales. Energy made up $579 million in revenue, delivering 759 MWh of energy storage and 57 MW of solar. Services and other sales brought in 581 million in revenue.

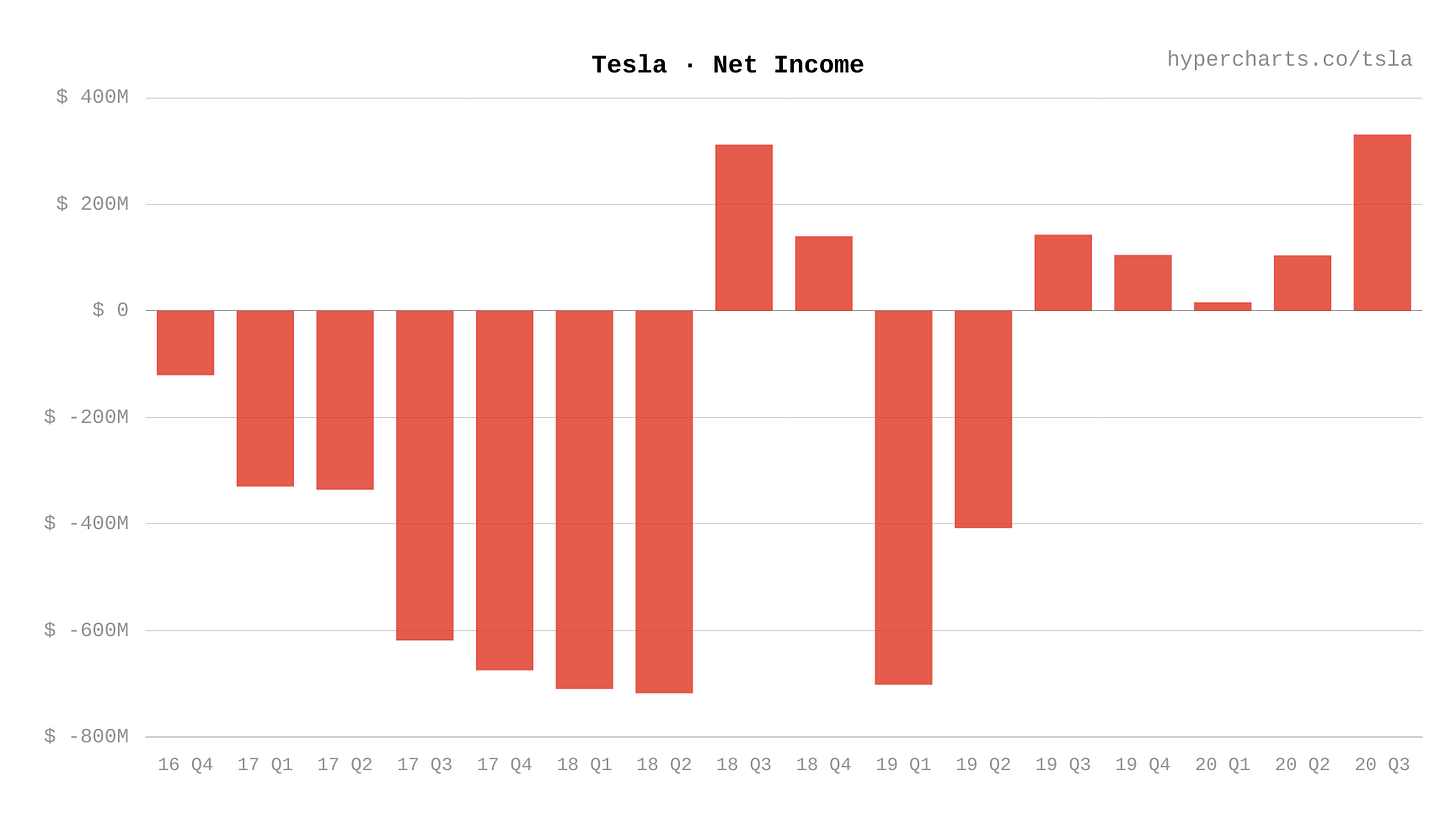

Profitability

Operating income reached $809 million, resulting in a 9.2% operating margin, beating estimates of $644 million and 7.8%, respectively. This record level of operating profitability was reached despite a $543M stock based compensation expense driven by CEO award milestones.

Tesla beat estimated EPS of $0.56 with an EPS of $0.76. Tesla also had its fifth sequential quarter of profitability with record net income of $331 million. This continues to raise the question of S&P 500 inclusion.

Operating cash flow less capex equalled $1.395 billion in Q3. This record setting free cash flow crushed estimates of $919 million.

Cash

Cash and cash equivalents increased by $5.9 billion in Q3 to $14.5 billion. Although free cash flow of $1.395 billion played a part in building this cash pile, the increase was driven mainly by the recent and timely capital raise of $5 billion when the stock was trading around $449.

Summary

Tesla achieved its best quarter yet with record deliveries, revenues, and profitability all while continuing to buildout three new factories in three different continents. Tesla is aiming to deliver another 180,000 vehicles in Q4 to meet its 500,000 yearly guidance despite being slowed down by shutdowns due to the pandemic earlier in the year. While it has become more challenging, it remains as their target and they are increasing their capacity to do so.

All Charts courtesy of Hypercharts

Very nicely presented!